Singapore’s public housing model is often heralded as a massive success. Over 80 percent of the resident population lives in a Housing and Development Board (HDB) flat, of which about 90 percent own them. These high rates of public housing ownership are quite rare, globally, earning HDB plaudits while its work has been turned into case studies at top universities around the world. “Lessons from the best public housing program in the world”, headlined an article from The World Bank in 2018. “From Slums to Sky Gardens–Singapore’s Public Housing Success”, gushed the American Society of Landscape Architects the same year, after HDB organised a tour for them.

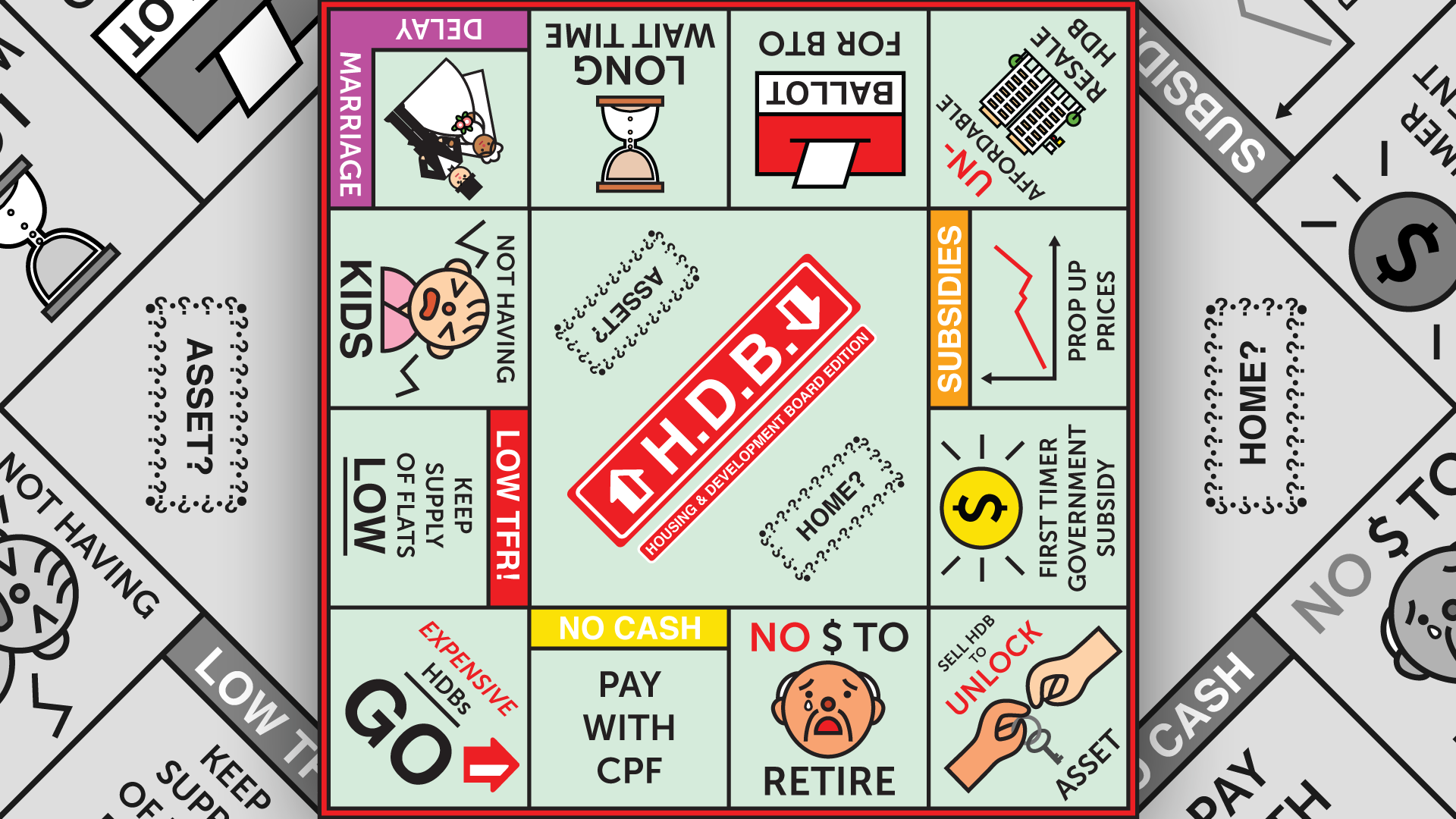

Yet, this rosy external view of Singapore’s public housing is increasingly out of sync with the domestic one. There is growing sentiment amongst the Singaporean populace that the words “affordable” and “accessible” do not reflect the public housing system today. HDB flat prices—both for resale and new units, the latter being tied to the former—have continued to climb aggressively in recent years, in tandem with property appreciation in open markets in the world’s major cities. Public housing units of over S$1m each, once unthinkable, are now commonplace. Just last month, there were 74 such units sold, a record. Wage growth hasn’t kept up: Singapore’s housing price-to-income ratio is now seemingly at one of its highest levels ever (details below).

These soaring prices are primarily rooted in demand outpacing supply. There are simply too few HDB flats for prospective buyers. That stated 90 percent homeownership statistic can be misleading, since it includes dependents, such as children and senior citizens, who live under the same roof even though they do not actually own the homes. It’s less home ownership per capita than home ownership per household. Moreover, they are not freehold properties but are all 99-year leasehold ones—thus many “owners” feel more like “lessees”.

Nevertheless, the upward price movement is undergirded by the fervent belief that public housing flats are ever-appreciating assets which will allow the homeowner to make a profit from the sale of their home. “85% of Singaporeans are living in HDB flats and we intend to keep the values of these homes up. It will never go down!” Lee Kuan Yew thundered in 2011, ahead of a crucial general election. Lee understood that Singaporeans’ household wealth had become heavily dependent on HDB prices. Over the decades, the government actively encouraged and facilitated the financing of HDB flats using Central Provident Fund (CPF) monies. In effect, the public housing system took on the additional role of a ‘retirement nest egg’ for the now older generation. If prices decrease due to radical policy actions, Singapore will effectively be eroding an entire generation’s worth of accumulated capital.

This has created a natural intergenerational tension: while older homeowners want prices propped up, younger prospective owners feel increasingly priced out of the market. This is occurring amid relevant global trends, such as increased capital inflows into Singapore, perceived as a safe haven by many foreigners; as well as local ones, such as HDB lease decay, which has started to challenge Lee’s frothy outlook on ever-rising prices.

With this situation unfolding, what options do we have now? In order to properly assess them, we need to first consider the origins of public housing in Singapore.